In recent events, Singaporeans have been hit with a series of economic updates that are bound to affect their daily lives. From IKEA’s price cuts to a drop in core inflation, rising energy costs, and impending GST rate hikes, it’s clear that the financial landscape is undergoing significant shifts. In this commentary, we’ll delve into the implications of these changes for the average Singaporean, particularly in terms of daily necessities. Additionally, we’ll explore Grab’s inelastic demand and its path to profitability in Singapore’s evolving economic climate.

IKEA’s Price Reduction: A Breath of Fresh Air

IKEA’s decision to slash prices on over 140 products couldn’t have come at a better time for cash-strapped Singaporeans. Consider the young couple setting up their first home. For them, IKEA is a haven of affordable yet stylish furniture and home essentials. The price reduction means that they can now invest in that much-needed dining table without blowing their budget. As the cost of housing and essentials like groceries and utilities continue to rise, this move by IKEA is a gesture of goodwill that will likely earn them lifelong customers.

Core Inflation and Strong Price Pressures: A Complex Scenario

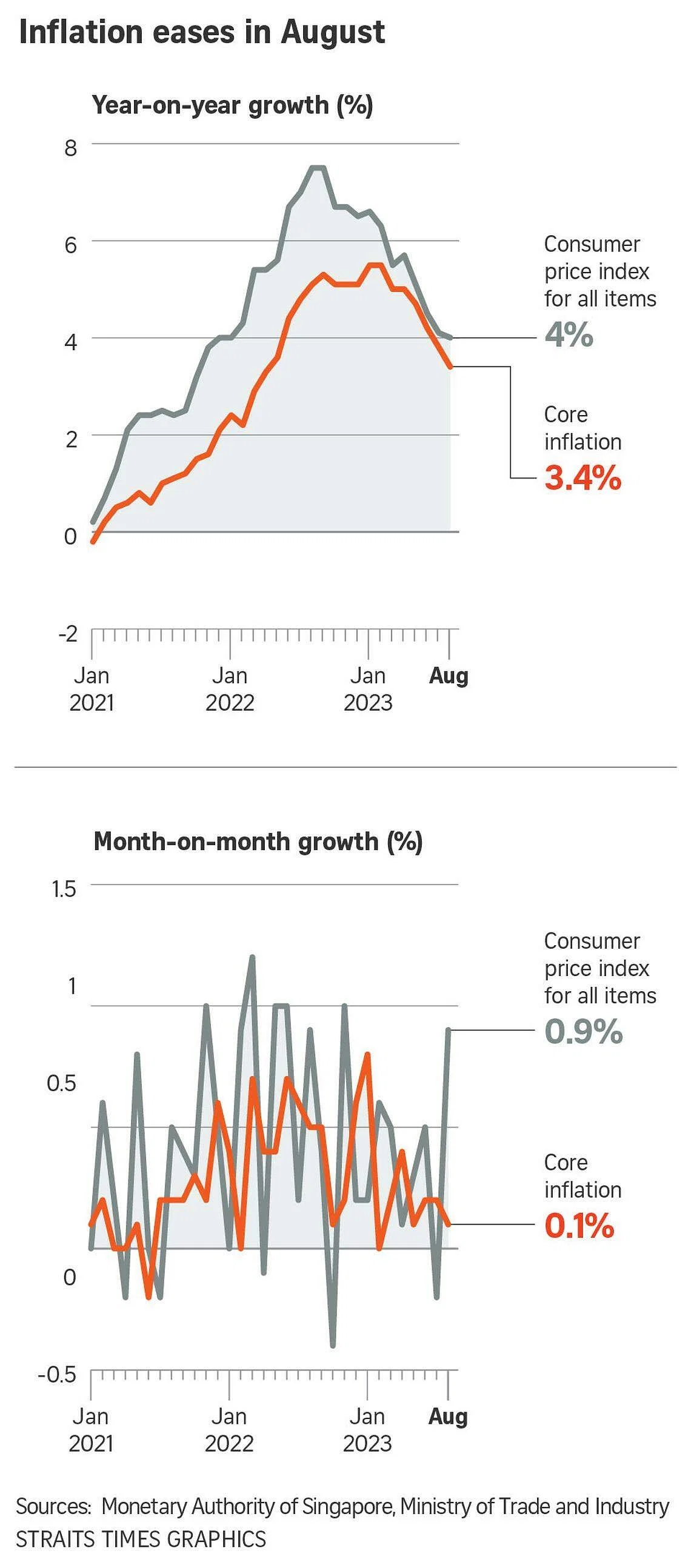

Each month, the Department of Statistics Singapore (DOS) meticulously compiles the Consumer Price Index (CPI) by aggregating price data from approximately 6,800 product brands across 4,200 retail outlets. Within the CPI basket, Core Inflation is a metric that tracks price changes of select goods and services, excluding accommodation and private road transport. Given its emphasis on everyday cost fluctuations, it’s the parameter that the Monetary Authority of Singapore (MAS) prioritizes in its monetary policy discussions.

The recent news of core inflation consistently declining over four months may initially appear as welcome news. This apparent relief results from the deceleration in the price increments of various services, food items, retail products, and other essentials. At first glance, a slowdown in the rise of prices across the consumer spectrum is a positive development.

However, it’s imperative to recognize that the intricate dynamics of supply and demand on a global scale have exerted a significant influence on Singapore. As a highly open economy heavily reliant on imported goods and services, Singapore is particularly vulnerable to global market fluctuations. For instance, essential commodities such as natural gas for electricity generation, fresh fruits and vegetables, and travel services, which collectively constitute a substantial portion of Singapore’s consumer spending, are predominantly imported. In fact, more than 90 percent of the food consumed in Singapore is imported.

This high dependence on international markets makes Singapore acutely responsive to shifts in global prices of goods and services. Consequently, a diminishing core inflation rate might not offer a comprehensive representation of the overall financial landscape. The costs associated with these fundamental sectors could continue to rise, even as core inflation appears to decrease. This disconnect has the potential to catch many Singaporeans off guard, leaving them puzzled about why their day-to-day expenses fail to align with the perceived drop in inflation.

The intricate interplay of global market forces and domestic economic realities underscores the complexity of Singapore’s inflationary landscape. While headline numbers might suggest a degree of stability, the intricate tapestry of everyday costs requires a more nuanced understanding. In this context, Singaporeans must remain vigilant and well-informed about the economic factors that affect their daily lives to make prudent financial decisions in an ever-changing financial environment.

Rising Electricity and Gas Tariffs: Impact on Households

Now, let’s consider the impact of rising electricity and gas tariffs. The typical Singaporean family already deals with high housing costs, and utilities make up a significant chunk of monthly expenses. An increase in these bills due to higher costs can put extra strain on an already tight budget. To cope with this, many families might need to reconsider their energy consumption, adopting more energy-efficient practices and maybe even investing in energy-saving appliances.

GST Rate Hike in 2023 and 2024: Balancing Act

The planned GST rate hike is a contentious topic. While it’s essential to fund healthcare and elderly care, the real question is whether this will push the prices of daily necessities even higher. Take, for example, a trip to the local supermarket. With the GST increase, a basket of groceries that used to cost $50 will now set you back $54 or more. This might not seem like much, but for families already struggling with the rising cost of living, every dollar counts.

Grab’s Inelastic Demand: A Strategic Moat Discovery Phase

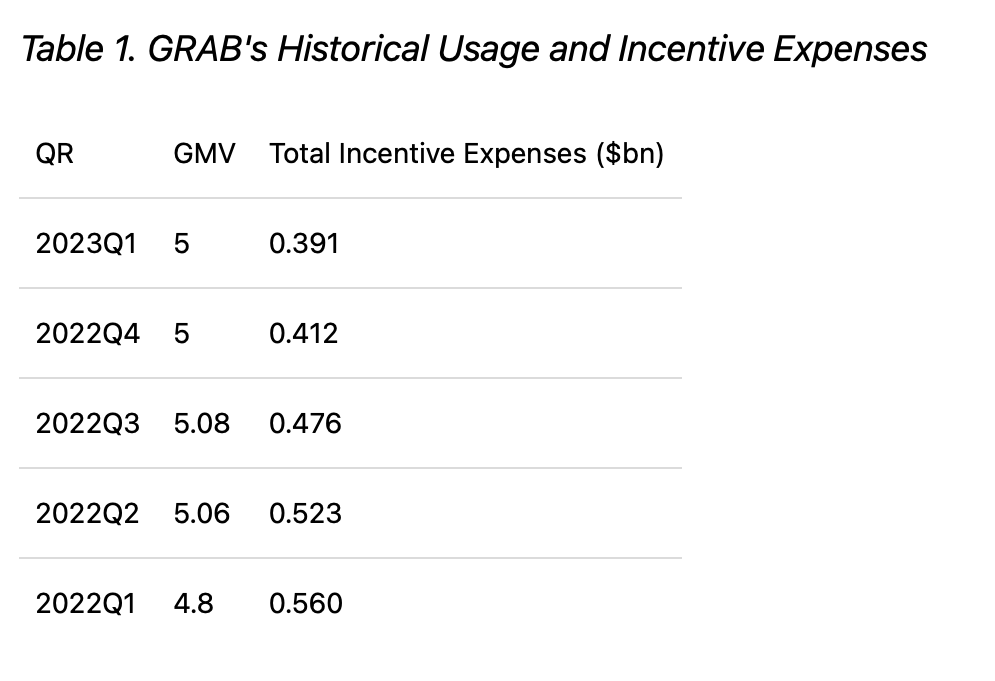

Amidst the dynamic shifts occurring in Singapore’s economic landscape, Grab, the giant of ride-hailing and delivery services, emerges as an intriguing case study. Examining the data presented in Table 1, a remarkable trend becomes evident. Gross Merchandise Value (GMV), serving as a proxy for the utilization of Grab’s services, remains relatively steady, even in the face of reduced incentive spending. The numbers unmistakably show that Grab has demonstrated the ability to maintain demand for its services despite a substantial 30% reduction in incentives.

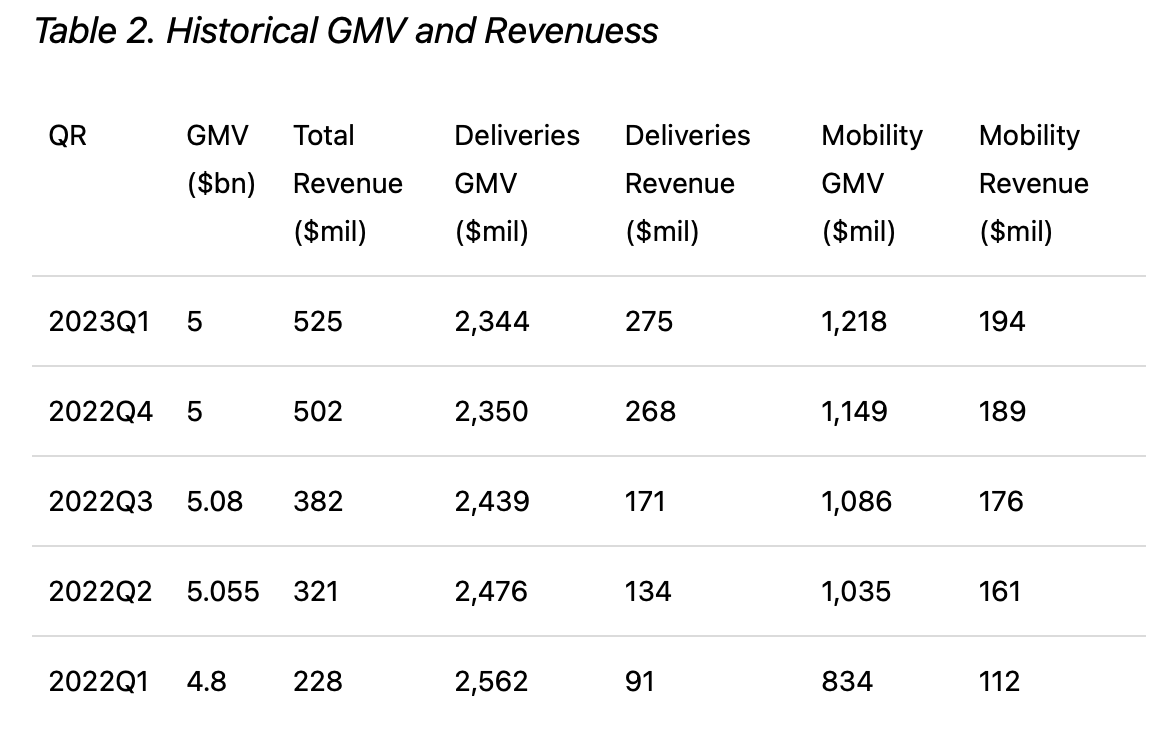

Now, if we turn our attention to Table 2, another intriguing pattern comes to light. Despite the GMV remaining flat, total revenue has experienced growth. To put it into perspective, during 2022’s second quarter, the deliveries and mobility segments contributed 42% and 50% of Grab’s total revenue, respectively. Fast forward three quarters, and deliveries and mobility have shifted to contribute 52% and 37% of Grab’s total revenue. In essence, deliveries have been responsible for a staggering 69% of Grab’s growth during this period.

This data suggests that Grab is currently in a phase of discovery. It appears to have embarked on the journey of finding the inflection point where an increase in commissions no longer translates to a proportional increase in revenue. In simpler terms, Grab is venturing into the territory of inelastic demand, where consumers are willing to pay higher prices for a product or service, even in the face of economic challenges.

This fascinating phenomenon underscores Grab’s robust market presence and the indispensable role it plays in the daily lives of Singaporeans. Whether it’s commuting, food delivery, or everyday convenience, Grab has solidified a substantial moat in the market.

In sum, Grab’s ability to maintain and even enhance its revenue streams in the face of reduced incentives and changing dynamics in the gig economy speaks volumes about its position as a market leader. It has successfully harnessed the power of inelastic demand, cementing its status as a staple in the lives of Singaporeans and hinting at a bright future in Singapore’s ever-evolving economic landscape.

My thoughts:

As a Singaporean living in Singapore, these economic developments raise important concerns. While it’s commendable that businesses like IKEA are taking steps to ease the financial burden on consumers, the government’s decision to raise the GST and the looming price pressures mean that we must be more prudent than ever with our finances.

I appreciate the government’s commitment to healthcare and eldercare, but it’s crucial that the burden of these expenses doesn’t fall disproportionately on the average citizen. As we navigate these uncertain economic waters, I hope that major retailers and employers will take heed and find ways to support Singaporeans during these trying times.

In conclusion, Singapore’s economic landscape is undeniably complex and multifaceted. It is imperative for individuals and businesses to stay informed, adapt to changes, and seek efficient ways to manage their finances as they navigate the challenges of rising costs and economic fluctuations.