The private housing market has been a rollercoaster ride for investors in recent years, but there are whispers of moderation in the air as we hit the 2nd Quarter of 2023. As someone interested in real estate investing, I’ve been keeping a close eye on these developments. In this blog post, we’ll delve into whether it’s a smart move to jump into the private housing market given the current state of mortgage rates and the intriguing alternative of Real Estate Investment Trusts (REITs).

Mortgage Rates and Profitability: Should I Worry?

Mortgage rates are a pivotal factor when it comes to the profitability of real estate investments. The higher the rate, the more it eats into your potential profits. When property prices climbed in late 2022 to early 2023 and mortgage rates similarly increased, I took the opportunity to divest my real estate investment property and re-balance my whole investment portfolio.

Nonetheless, here’s my take after three months:

a) Long-Term Vision: Investing in real estate isn’t a quick flip; it’s a long-term commitment. So, while high mortgage rates may seem daunting upfront, they might not be the deal-breaker they seem if you plan to hold onto the property for years. Property values can appreciate over time, helping offset those seemingly exorbitant interest costs.

b) Shopping Around: Don’t settle for the first mortgage rate you encounter, especially when the current mortgage rates are expected to continue into late 2024. Take your time to find a deal that suits your financial picture.

c) Crunching Numbers: Although rental demand, on the whole, in Singapore, whether public housing or condominium, went up by 24.1 per cent and 21.6 per cent between July 2022 to July 2023 respectively, it is prudent to still calculate your potential rental income and expenses meticulously. High mortgage rates can be manageable if your property generates positive cash flow. Positive cash flow is the lifeline of your investment.

d) Diversification Is Your Friend: High mortgage rates can be concerning, but you can mitigate risk by diversifying your investment portfolio. Spreading your investments can help balance your overall returns.

A Decline in Private Housing Prices: A Rarity Since 1st Quarter 2020

Perhaps one of the most attention-grabbing aspects of the 2nd Quarter of 2023 is the slight decline in overall private housing prices. This is a noteworthy event because it’s the first time we’ve seen such a dip since early 2020. What’s causing this? It’s mainly due to a drop in prices for non-landed properties and a significant moderation in the price increase for landed properties compared to the previous quarter.

My take on this: While it might be tempting to interpret this as a red flag, it’s essential to remember that the real estate market is cyclical. Periods of price correction can often be followed by periods of growth. It’s an opportunity for those with a long-term perspective to potentially snag properties at a more favorable price point.

Slower Growth in Rental Rates: A Change of Pace

Another noteworthy shift is the slowdown in the growth of private residential property rentals. In the 2nd Quarter of 2023, we saw a quarter-on-quarter increase of 2.8%, a notable drop from the 7.2% surge in the previous quarter. This is the smallest gain we’ve witnessed since late 2021.

My perspective: This shift in rental growth could indicate a more balanced market, which is a positive sign for both investors and tenants. It might mean a slightly longer time to recoup your investments through rent, but it could also lead to more stable and sustainable rental income in the long run.

A Surge in Supply: What Does It Mean for Investors?

One of the most significant developments in the private housing market is the surge in supply. In the first half of 2023, the number of private residential property completions more than doubled compared to the same period in 2022. And for the entire year, a whopping 20,500 private residential units are expected to be completed – the highest annual supply completion since 2017.

What’s more, the government has ramped up the supply through the Government Land Sales Programme, with the highest total Confirmed List supply in a decade, around 9,250 units for 2023.

In my view: This influx of supply might seem overwhelming, but it can be viewed as an opportunity for diversification. More choices mean a better chance of finding the right investment that suits your goals and risk appetite.

REITs vs. Real Property: What’s Your Game Plan?

While I await for clearer and favourable conditions on Real Property, Real Estate Investment Trusts (REITs) have emerged as an enticing alternative to physical property investments. But are they the golden ticket? Let’s weigh the pros and cons.

Pros of REITs:

a) Liquid Assets: REITs trade like stocks, offering liquidity that physical properties can’t match. You can buy and sell REIT shares with ease.

b) Built-in Diversification: REITs often have diverse real estate assets in their portfolios, from residential to commercial properties. This diversification can help spread risk.

c) Expert Management: Professionals manage REITs, handling property management and maintenance, which can be a relief for hands-off investors.

d) Dividend Potential: REITs are required to distribute a significant portion of their income to shareholders, making them attractive for those seeking regular income.

Cons of REITs:

a) Limited Control: Investing in REITs means relinquishing control over property management decisions, unlike owning physical properties.

b) Market Volatility: Just like stocks, REIT prices can be subject to market volatility, potentially leading to losses.

c) Tax Drawbacks: REITs don’t offer the same tax benefits as owning real property, such as mortgage interest deductions and property depreciation.

d) Market Correlation: REITs can be correlated with broader equity markets, reducing their effectiveness as diversification tools.

In my view, the current state of the private housing market and the high mortgage rates pose both challenges and opportunities. Whether you decide to invest in physical properties or opt for REITs should be a reflection of your unique investment strategy and objectives.

EPRT’s Strong Financial Performance: Beating Expectations

I’ve recently turned my attention towards Essential Properties Realty Trust (NYSE: EPRT). This real estate investment trust has been making waves in the market, and I want to share my views on why it could be an enticing prospect.

One of the key factors that caught my eye is EPRT’s impressive financial performance. The latest earnings report showed a Funds From Operations (FFO) of $0.44, surpassing expectations by $0.02. Additionally, their revenue of $86.52 million exceeded estimates by $2.19 million. Such financial strength can be an indicator of a well-managed and resilient REIT.

Exceptional Total Return Over the Last 5 Years

EPRT’s track record is nothing short of remarkable. Over the last five years, it has nearly doubled the total return compared to the S&P 500. This impressive performance suggests that EPRT has managed to consistently generate value for its investors.

High Occupancy Rates and a Unique Investment Focus

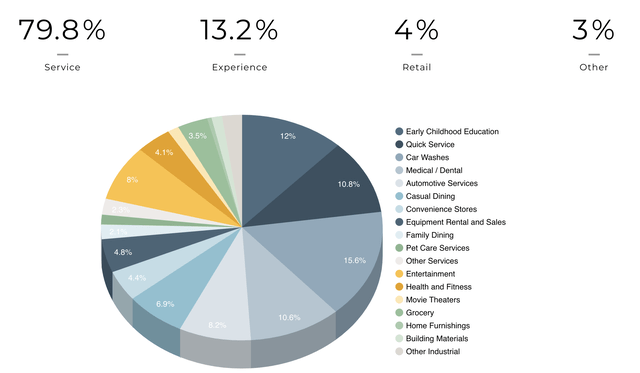

EPRT boasts an exceptional occupancy rating, standing at a remarkable 99.9% at the end of Q2. What’s even more interesting is their differentiated investment platform, which focuses on non-investment-grade tenants. This unique approach has evidently paid off, ensuring a stable and consistent income stream.

Attractive Prices in the Current Macro Environment

Given the current macroeconomic environment, many REITs, including EPRT, are trading at attractive prices. This presents an opportunity for investors looking for potential double-digit upside. EPRT’s ability to weather economic storms and maintain strong occupancy rates is a testament to its resilience.

Attractive Dividend Yield

In closing coverage of this asset, it is worthwhile to mention Essential Properties’s dividend yield of 4.54%, which, if coupled with its three-year average dividend growth rate of 6.9%, conveys a dividend growth opportunity.

As always, I encourage thorough research and consultation with financial advisors before making any investment decisions. The real estate market can be complex, but opportunities like EPRT are a reminder of the potential for long-term success in this space. Keep a close eye on EPRT, and it might just become a cornerstone of your investment strategy.