Ticker NYSE: PLTR

Price at Publication: $18.05

In recent times, the financial landscape has witnessed some remarkable events that demand our attention. The Federal Reserve’s decision to raise interest rates to the highest level in 22 years has sent ripples through the market, raising concerns about an impending economic slowdown. Additionally, the emergence of generative AI hype in the stock market has captivated investors’ imaginations, creating both opportunities and risks. In these uncertain times, it’s crucial to re-evaluate our investment strategies and consider the merits of value investing. In this blog, we will explore value investing and how it can be a prudent approach during times of economic uncertainty and technological transformations.

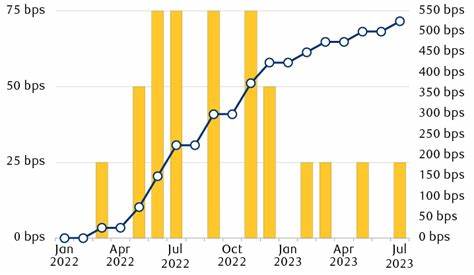

- Federal Reserve’s Interest Rate Hike

The Federal Reserve plays a pivotal role in shaping the US economy through its monetary policy decisions, and the recent interest rate hike reflects their efforts to combat inflationary pressures and stabilize economic growth. A higher interest rate generally leads to reduced borrowing and spending, which can eventually result in an economic slowdown. As investors, we need to be mindful of the potential consequences of these decisions on various asset classes and sectors.

- Anticipating an Economic Slowdown

With the interest rate hike, it’s reasonable to expect a slowdown in economic growth. During periods of deceleration, certain sectors like technology and consumer discretionary might be impacted more severely, while defensive sectors like utilities and consumer staples tend to fare better. Investors should rebalance their portfolios accordingly, focusing on companies with strong fundamentals and sustainable business models.

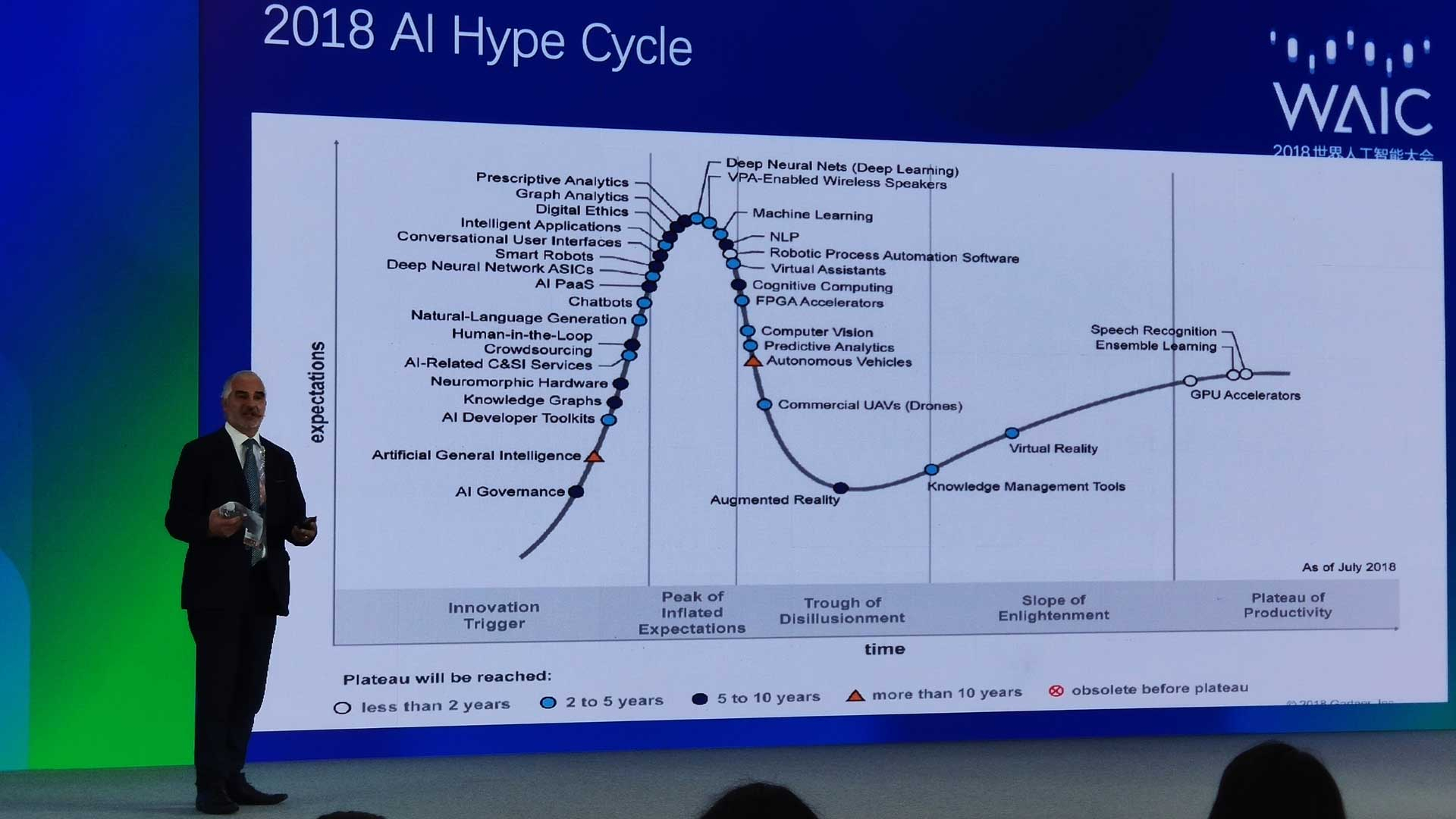

- Generative AI Hype in the Stock Market

Generative AI, the technology that enables machines to produce human-like outputs, has sparked immense excitement and investment interest. While this technological advancement holds vast potential, it is essential to exercise caution. Not every company riding the generative AI wave will succeed, and investors should conduct thorough research before allocating their funds to these emerging technologies.

The Pitfalls of Over-Speculation:

- Exaggerated Valuations: Over-speculation often results in inflated stock prices that do not align with a company’s true value or revenue potential. This disconnect can lead to a sudden correction when market sentiment shifts.

- Volatility: Over-speculation contributes to heightened stock price volatility. Rapid price fluctuations can lead to knee-jerk reactions and emotional decision-making among investors.

- Lack of Fundamental Analysis: When investors become fixated on hype, they may neglect to conduct thorough fundamental analysis. Sound investment decisions require a comprehensive understanding of a company’s financials, competitive advantage, and growth prospects.

- Herding Behavior: Over-speculation tends to drive herding behavior, where investors follow the crowd without considering individual research. This can result in a distorted market perception and unsustainable price movements.

Exercising Caution: Practical Steps for Investors

- Conduct In-Depth Research: Before investing in a generative AI company, delve into its financials, business model, and competitive landscape. Assess the company’s potential for long-term value creation rather than short-term speculative gains.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversification across sectors and industries can mitigate risks associated with individual stock volatility.

- Stay Informed: Continuously monitor news and developments in the generative AI sector. Being well-informed enables you to discern between substantive advancements and hype-driven trends.

- Long-Term Perspective: Over-speculation often pertains to short-term gains. Maintain a long-term investment horizon and focus on companies with solid fundamentals and growth potential beyond market fads.

- Set Clear Investment Goals: Define your investment goals and risk tolerance. Having a clear plan in place can help you resist impulsive decisions driven by market sentiment.

- Consult Professionals: If navigating the intricacies of generative AI investments feels overwhelming, seek advice from financial professionals who specialize in emerging technologies and investment strategies.

One such case is Palantir Technologies (NYSE: PLTR), a company that has experienced a roller-coaster ride fueled by the AI hype train.

Palantir Technologies (NYSE:PLTR), the unliked enterprise software data play was once so hated, underwent a remarkable transformation in investor sentiment this year. Trading at below $8 in early May this year, the stock’s meteoric rise since the beginning of the year, with gains of around 185%, is nothing short of astounding. Such exponential growth often raises eyebrows and calls for a closer examination of the factors at play.

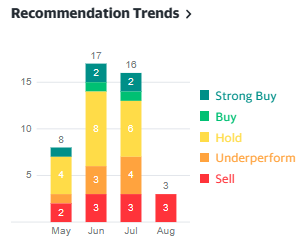

The rally that propelled Palantir back to $20 is a testament to the generative AI hype that has gripped the stock market. The rapid appreciation of the stock, however, has brought to the forefront concerns about its valuation. With a trading price nearly 18x analyst sales targets, the question arises: can Palantir truly justify its current valuation without a substantial AI boost?

All eyes are now on Palantir’s upcoming Q2 results, slated to be reported post-market today for the period ending June 30th, 2023. Analysts’ expectations reveal a projected GAAP EPS of 1 cent on revenue of $533.57 million. This anticipated performance could mark Palantir’s third consecutive profitable quarter, a significant achievement. However, it also raises the stakes for the company to continue meeting its profitability goals, as outlined in its guidance for each quarter of 2023.

Investors who currently hold Palantir stock or are considering an investment need to scrutinize the company’s fundamental strengths, growth prospects, and its ability to translate AI innovations into sustainable value. The volatility that often accompanies over-speculated stocks like Palantir underscores the importance of conducting thorough research and adhering to a long-term investment strategy.

- The Merits of Value Investing

Value investing is an investment approach pioneered by Benjamin Graham and popularized by Warren Buffett. It involves identifying undervalued companies whose stock prices do not reflect their intrinsic value. Instead of being swayed by market sentiment or short-term trends, value investors focus on the fundamental strength and long-term prospects of a company.

- Identifying Signs of Value Investing in the Stock Market

a) Low Price-to-Earnings (P/E) Ratio: A low P/E ratio suggests that a company’s stock is relatively inexpensive compared to its earnings. This might indicate that the market has undervalued the company.

b) Low Price-to-Book (P/B) Ratio: The P/B ratio compares a company’s market value to its book value (assets minus liabilities). A ratio below 1 implies the stock might be undervalued.

c) Dividend Yield: Companies with a history of stable or increasing dividends can indicate financial strength and a commitment to shareholder returns.

d) Strong Fundamentals: Analyze a company’s financial statements to ensure healthy revenue growth, strong profit margins, and manageable debt levels.

e) Market Overreaction: In turbulent times, market sentiments might lead to irrational price movements. Value investors look for opportunities where the market has overreacted, causing a stock’s price to fall below its intrinsic value.

Conclusion

Generative AI undoubtedly represents a remarkable leap in technological innovation, holding the potential to reshape industries and unlock new possibilities. However, the allure of quick gains and over-speculation can cloud rational judgment and lead to undesirable outcomes. As an investor, your goal is not only to capitalize on emerging trends but also to build a resilient and balanced portfolio. By conducting thorough research, staying informed, and maintaining a long-term perspective, you can navigate the generative AI landscape with caution and make investment decisions aligned with your financial aspirations. Remember, prudent investing is a journey that demands discipline, diligence, and a steady hand in the face of market excitement.

More readings:

- Fed’s Bowman says more US rate hikes likely will be needed | Reuters

- Why Palantir’s Stock Climbed 29% in July | The Motley Fool

Disclaimer: The information provided in this blog is for educational and informational purposes only. It is not intended as investment advice, financial guidance, or a recommendation to buy, sell, or hold any securities or assets mentioned. The content is based on the author’s interpretation of the topics and may not reflect the most current developments in the financial markets.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Readers are advised to conduct thorough research and consult with qualified financial professionals before making any investment decisions. The author and the platform assume no responsibility or liability for any errors, inaccuracies, or omissions in the content or any actions taken based on the information provided.

The stock market and investment landscape are dynamic and subject to rapid changes. The value of investments can fluctuate, and investors should be aware of the potential risks and uncertainties associated with investing. All investment decisions should be made with careful consideration of individual financial goals, risk tolerance, and current market conditions.

By reading this blog, you acknowledge and agree that neither the author nor the platform shall be held responsible for any consequences that may arise from the use of the information presented. You are encouraged to seek professional advice and perform your own due diligence before making any investment decisions.