Introduction

In an ever-changing and complex world, financial literacy has become an indispensable skill for navigating the intricacies of personal finance and achieving long-term financial success. However, many people find the concept of financial literacy intimidating, assuming it requires advanced knowledge of economics and accounting. In this blog, we will explore what financial literacy truly means, debunk common misconceptions, and emphasize its importance in building a secure financial future.

Understanding Financial Literacy

Financial literacy refers to the capacity to grasp and proficiently handle different aspects of personal finance, encompassing essential concepts like budgeting, saving, investing, borrowing, and debt management. In essence, being financially literate empowers individuals to make informed and sensible decisions concerning their money. These decisions have the potential to accumulate and impact our financial well-being in the long run. However, the path to financial literacy might seem uncertain for many, regardless of their stage in life – whether they are close to retirement or just entering the workforce. Nonetheless, understanding financial literacy can lay the foundation for a sustainable and secure financial future.

Debunking the Myth: Is Financial Literacy Difficult to Understand?

One of the most pervasive myths surrounding financial literacy is that it requires an advanced understanding of complex financial jargon and economic theories. While those aspects might be relevant for financial professionals, financial literacy for the average person is far more straightforward and accessible.

Financial literacy is not about mastering intricate financial models; it is about developing basic skills and knowledge that are relevant to our everyday lives. By breaking down financial concepts into simpler terms and taking a step-by-step approach, anyone can grasp the fundamentals of financial literacy.

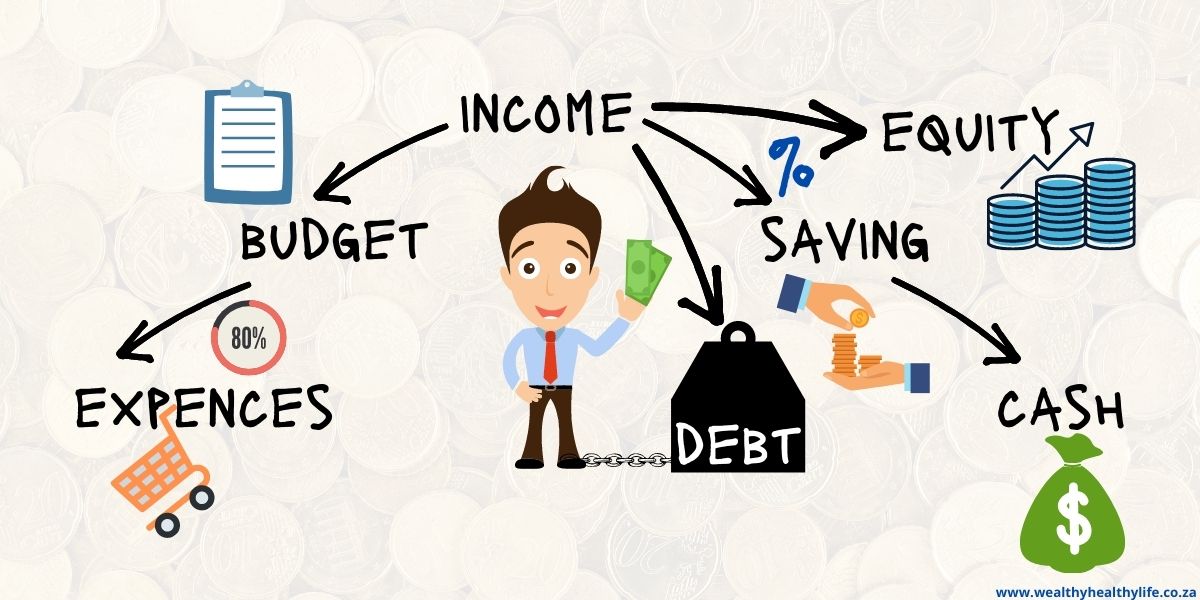

Components of Financial Literacy

- Budgeting: The foundation of financial literacy lies in creating and maintaining a budget. This involves monitoring income, expenses, and setting specific financial goals. A well-structured budget enables individuals to exercise control over their spending, establish emergency funds, and accomplish their financial objectives. In my early twenties, I adopted a method of automatically allocating my salary to different accounts, such as Savings, Investments, Insurance, etc., leaving the remaining amount for daily expenses, including credit card bills. This disciplined approach greatly improved my budgeting habits.

- Saving: Recognizing the significance of saving is paramount in building a safety net. Financially literate individuals comprehend various saving methods, such as establishing emergency funds and contributing to long-term savings accounts like retirement plans. As part of my financial discipline, I allocated approximately 30-40% of my disposable income to Savings.

- Investing: Investing may seem daunting, but financial literacy simplifies the process. Learning about different investment options, risk tolerance, and long-term planning empowers individuals to make informed investment decisions. When my accumulated savings reached a certain threshold, I began investing in stocks, unit trusts, etc. Starting small allowed me to gradually boost my confidence and remain composed during periods of underperformance, knowing that fluctuations are natural and temporary.

- Managing Debt: Financial literacy involves understanding the repercussions of borrowing money and utilizing credit responsibly. It necessitates knowledge of interest rates, credit scores, and effective debt management strategies. Personally, I prefer to avoid debts, especially those that do not contribute to growing my Savings but deplete them instead.

- Financial Goals: An integral aspect of financial literacy lies in setting attainable financial objectives. Whether it involves buying a house, paying off student loans, or retiring comfortably, having clear and achievable goals provides motivation and direction in one’s financial journey.

Having a well-structured budget and a solid foundation of financial literacy allows you to dream big and turn those dreams into tangible goals. Throughout my financial journey, I set ambitious yet achievable objectives that became the milestones guiding my path to success.

- Paying Off Student Loan by Age 27: Completing my degree at 24, I understood the importance of managing my finances responsibly. Consequently, my first financial goal was to pay off my student loan by the age of 27. By diligently adhering to my budget and saving strategies, I successfully achieved this milestone, liberating myself from the burden of debt and creating a strong financial footing for the future.

- Buying a Property by Age 30: Owning a home was a paramount aspiration, and by the age of 30, I wanted to see this dream materialize. With a well-managed budget and a disciplined approach to saving, I accumulated enough funds for a down payment and secured my first property. This achievement not only provided a sense of pride but also marked a significant step towards building wealth and financial stability.

- Buying a Second Property by Age 35: With an ever-growing financial acumen, I continued to set my sights higher. I aimed to acquire a second property as a strategic investment. By diversifying my portfolio and understanding different investment options, I managed to achieve this goal, further solidifying my financial position.

- Purchasing a Car at Age 38: Although personal finance revolves around building wealth, it’s equally vital to acknowledge the value of rewarding oneself for dedication and hard work. As a result, I decided to buy a car. However, after three years of driving, I came to the realization that it wasn’t a necessity, so I made the responsible choice to dispose of it.

- Retiring by Age 45: With prudent investments and diligent financial management, I was able to expedite my journey towards financial independence. My goal to retire by the age of 45 was ambitious but within reach. Achieving this goal allowed me to explore new passions, spend quality time with loved ones, and live life on my terms.

- Starting a Small Business to Enjoy Life: Retirement did not mean slowing down for me; instead, it marked the beginning of a new chapter. To pass the time and find joy in pursuing my interests, I’m currently planning to start a small business. This venture not only added purpose to my days but also provided a source of supplementary income.

Conclusion:

Financial goals are not just dreams; they are the stepping stones that bridge the gap between aspirations and reality. With financial literacy as your compass, budgeting as your map, and determination as your driving force, you can set and achieve meaningful goals that pave the way to a fulfilling and prosperous life. Remember, each goal accomplished is not merely a destination reached, but a testament to the power of financial literacy in transforming dreams into reality.